Market Update: Who's Taking Your Market Share?

Oct 17, 2025

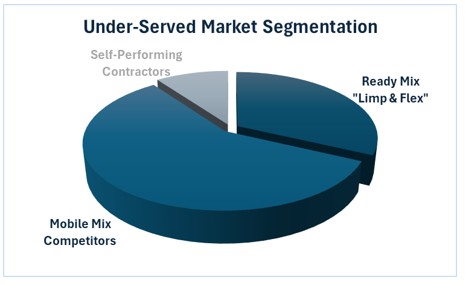

The current US Mobile Mix market opportunity we estimate to be 4,600 mixers needed to fulfill the 4% Underserved & Specialty Segments (Underserved). However, this estimate is directly affected by the market presence of Ready-Mix suppliers, who currently maintain the remaining significant share of the market and do not want to lose any volume. This is especially true in periods of time when the market is down. Even though small orders of concrete are very inefficient for them to supply, they tend to grope around within this space resulting in a “Limp & Flex Strategy”. While clumsily moving about they flex their perceived position of strength via price reduction all in the name of market share to preserve volume. As a result, the underserved portion is a highly contested part of the “pie” especially by the distributor model which are typically small independent truckers that purchase a few drum mixer trucks and purchase the raw ingredients from prominent Ready-Mix producers. These independent truckers will target the Underserved contractor base with the same results, poor customer experience in exchange for lower prices. This is a part of the market where the Mobile Mix industry falls short of addressing and leaves opportunities on the table.

The lack of sophisticated and disciplined selling practices within the majority of Mobile Mix producers all too easily gives up and surrenders this 32% ‘Limp & Flex” of the underserved market that should be served by Mobile Mix producers. In fact, it is our opinion that an improved sales effort industry wide would make this much less of a miserable experience for Mobile Mix producers when fending off the higher level of competition experienced within this 32% segment of the market. The critical point here is that the estimated 4,600 mixers in the US are competing within the 32% “Limp & Flex” segment and are having to fight it out on price directly with Ready-Mix producers. Ineffectively communicating and then failing to execute daily the Mobile Mix value proposition always leads to failure and hinders your specific market growth and thus the broader Mobile Mix industry growth. By executing strategies and tactics to build competitive barriers against these Ready-Mix competitors, the industry could capture an additional 15%-20% of the total market over time, increasing the success of Mobile Mix producers.

Although not all the “Limp & Flex” Ready-Mix producers can be eliminated from their misguided strategies, a market-driven high service focused Mobile Mix fleet across the nation could take back a share of the market. In some mature markets across the country the number of Mobile Mixers should be higher. Where we typically see a higher Mobile Mix share percentage are in battlegrounds that feature specific products such as Fast Set-Flowable Fill, Rapid-Set mixes, Latex Modified, Cellular Grout, Shotcrete, and Batch On-Site projects. These products along with a high level of consistent customer service(s) create barriers to the “Limp & Flex” suppliers. For one it’s very difficult to produce these products in a drum mixer, and the service level required is too much for the drum mixer crowd. A great example of this is in Austin, TX where the typical estimate for the “Underserved” Mobile Mix opportunity is 4% of the total concrete market, firsthand knowledge tells us that it’s closer to 7% of the total concrete market. The primary reason is that all the Mobile Mix “friendly” products listed above have been developed and offered over time by the more sophisticated Mobile Mix producers in Austin. That’s almost double the typical Mobile Mix opportunity found in most US markets. On the service execution side, we have clients that have weathered the “Limp & Flex” onslaught. Although the Ready-Mix competition attempted to entice their customers away with 20% + discounts, their top customers have stayed with them because of their service model and execution. Meaning they’ve done a great job of demonstrating the value proposition on a daily basis, which clearly differentiated them from the competition. Unfortunately, our experience has indicated that the majority of Mobile Mix producers do not have the knowledge, nor have they acquired the skills needed to take advantage of the opportunities and thus are underperforming both in up-markets and even more so in down-markets. It does not have to be that way.

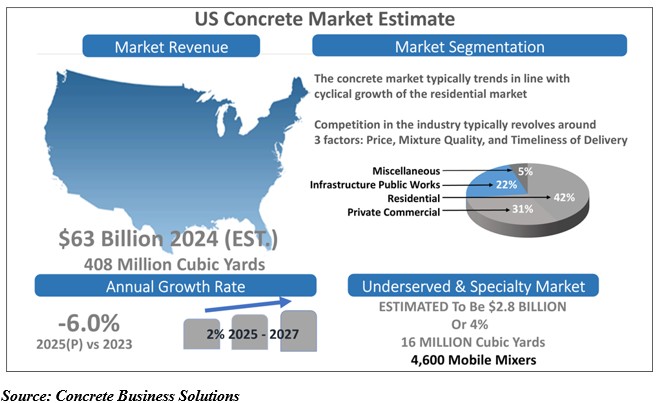

Concrete Market Size

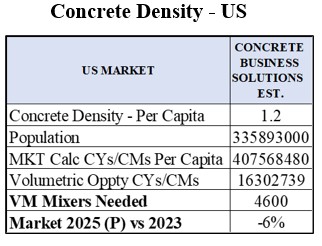

Concrete Density - US

The projected cement and subsequently concrete consumption for 2025 will be 6% less than in 2023. There are a number of major cities within the US that are projected by year-end to be down -18% from year-end 2023. Over 20 major cities will see a drop of at least -11% for 2025 (P) vs 2023. The American Cement Association (ACA) formerly known as PCA states that as current economic headwinds subside, the modest cement consumption growth will return in 2026 before more robust growth surfaces in 2027.

US Regional Market Summary

The data across the five regions-West, Southwest, Midwest, South, and Northeast-highlights the shift in concrete demand. U.S. cities comparing Year-End 2023 versus 2025 projected Year-End concrete market growth.

- Widespread Declines in Demand: Most metropolitan areas are experiencing a reduction. Notably, large cities such as Los Angeles (-2%), Dallas/Ft. Worth (-4%), Chicago (-7%), Miami (-11%), and Boston (-18%)

- Greatest Declines Concentrated in the Northeast: Cities in the Northeast—including New Haven/Hartford, Boston, Pittsburgh, and NYC/Jersey—are seeing the most significant drops, with declines reaching up to -18%.

- Mixed Performance in the Midwest: While several cities like Detroit, Milwaukee/Racine, Des Moines, Omaha, Sioux Falls, and Fargo show modest positive growth (up to 6%), most others in the region still face declining or stagnant demand.

- Stable or Slight Growth in Select Cities: A handful of markets, particularly in the West (Seattle, San Diego, Portland, Las Vegas, Boise, Billings) and Midwest, are projected to see low but positive growth mostly around 2%–6%.

- South Market Volatility: Major Southern markets like Miami, Atlanta, and Tampa are projected to decline up to -14%, while other cities such as Nashville, Memphis, and Louisville are expected to remain stable.

As stated, there are specific strategies, tactics, and methods that can help prevent total capitulation to the Ready-Mix “Limp & Flex” onslaught and to position you for greater success as the market begins to come back in 2027. What are you going to do between now and then to position your company for greater success?

Perhaps now is a good moment to examine your business more closely or seek advice on your current and upcoming plans. Concrete Business Solutions is here to come alongside and support you in every aspect of your business.

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.